Retire My Way

Hi, I'm Felicia Kestenberg

Owner of the Kesten Financial Group, located above Grand Central in mid-town New York City.

Neglecting your distribution strategy can come at a significant cost. Particularly for those approaching retirement or currently in retirement, there are several concerns that contribute to a sense of uncertainty.

These worries include:

taxes

inflation

interest rates

stock market volatility

the political environment

the current geopolitical landscape

These factors are outside our control, and it's impossible to predict their outcomes. Now, let's examine some significant challenges that you and your retirement plan might encounter.

Taxes.

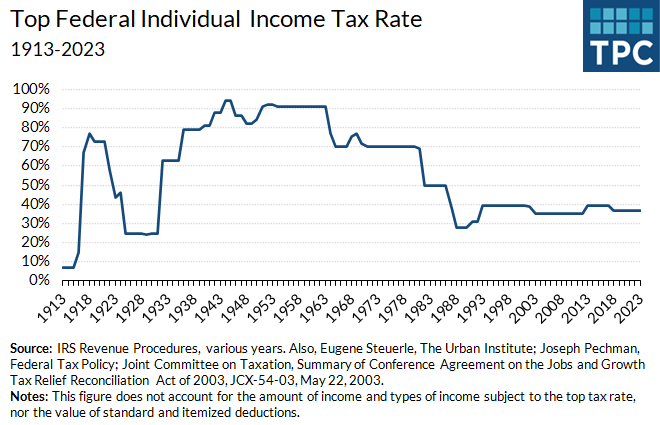

It's important to note that current federal income tax rates are historically low.

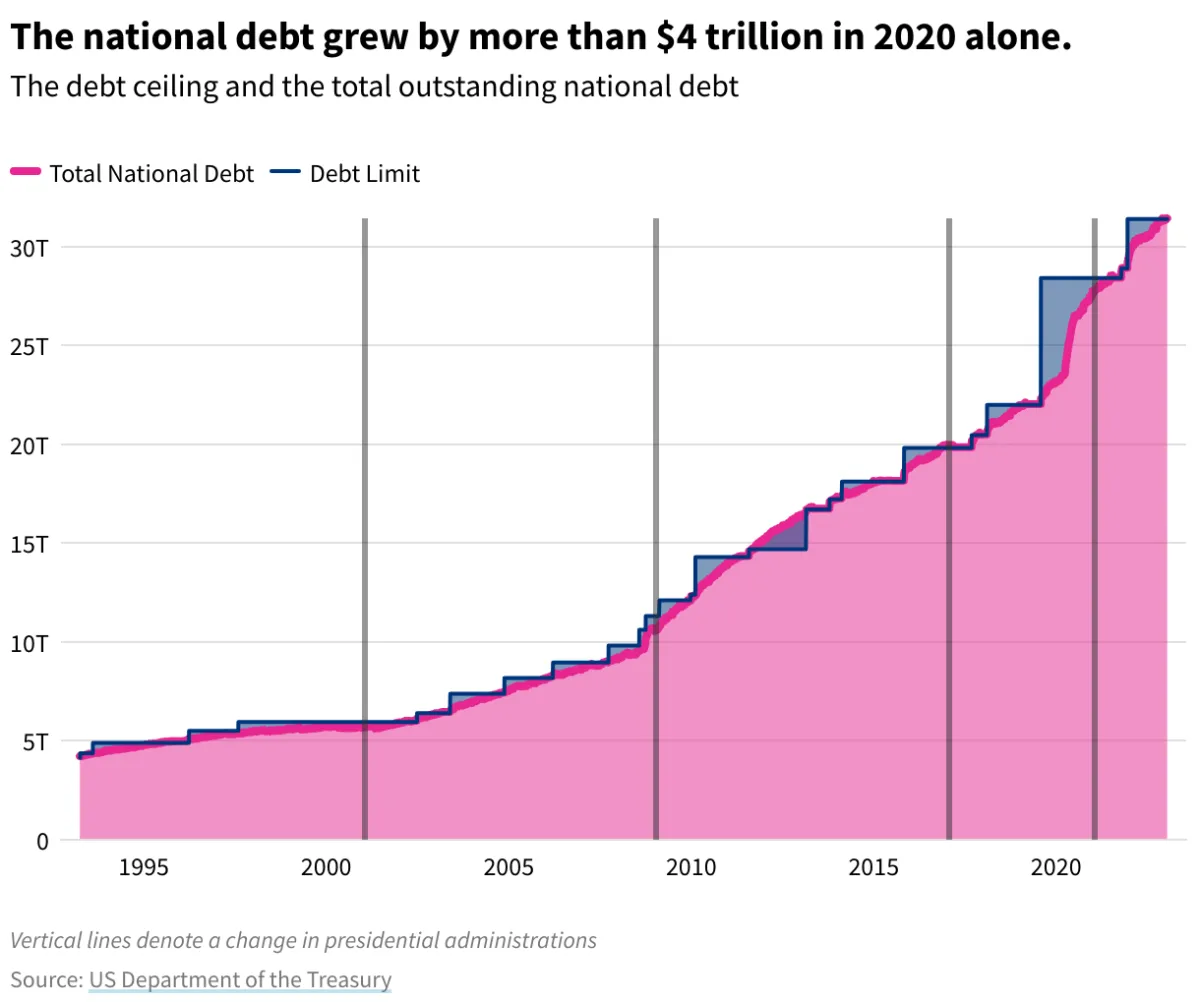

With the increasing government debt, taxes are likely to rise in the future. Changes in tax laws can definitely have an impact on your portfolio and retirement plans. Higher taxes can reduce your investment returns and potentially affect the amount of money you have available for retirement.

The current federal estate tax law will sunset on 12/31/2025, impacting wealth transfer to your family.

The implementation of the Secure Act I and Secure Act II has eliminated the stretch IRA, and must be withdrawn 10 years from inheritance.

Subsequently, may also create a tax burden for your family when inheriting your retirement assets.

Without a well-planned distribution strategy, taxes can become a significant expense during retirement, directly impacting the funds available for your retirement dreams and the longevity of your retirement funds.

Taxes can be a significant expense during retirement, and without a well-planned distribution strategy, you may end up paying more than necessary.

This can directly impact your investments available for your retirement dreams, such as traveling, pursuing hobbies, or covering unexpected medical expenses. It can also affect the longevity of your retirement funds.

Withdrawal Rate.

To effectively manage retirement assets and meet income requirements, it's essential to create a strategic withdrawal plan considering your retirement timeline.

To effectively manage retirement assets and meet income requirements, it's essential to create a strategic withdrawal plan considering your retirement timeline.

Tax-efficient withdrawals help maintain sustainable withdrawal rates over time.

The standard industry withdrawal rate is typically between 2-4%, dependent on factors such as the amount saved for retirement, retirement income needs, and the intended retirement age.

Withdrawing too much can deplete your portfolio and potentially run out of funds to support your retirement.

Taxes + withdrawal rates

When taxes and withdrawal rates are combined, it is apparent they can significantly impact your retirement plans. Kesten Financial Group offers services designed to address each person's unique situation and help them achieve their goals.

We provide financial education, proven strategies, and planning tools to assist you in making informed decisions with clarity and confidence.

Let’s prioritize planning for retirement since it is typically longer than any vacation you may ever have.

Retirement Roadmap.

Creating a retirement roadmap/financial plan is essential for pre-retirees and those already in retirement.

The Retirement Roadmap is designed for anyone aged 40-70 to ensure they are on track for a prosperous retirement. At Kesten Financial Group we provide a complimentary retirement score specific to your situation.

This service seeks to increase your score by adjusting your circumstances, helping lower or eliminate taxes in retirement, mitigating the effects of market volatility, and ensuring you never run out of money in retirement.

We understand the importance of tax efficiency in retirement and offer strategies to mitigate tax liabilities. Financial adjustments can help manage taxes while providing more funds for retirement enjoyment.

We also address the challenges of sequence of returns risk and its impact on retirement savings.

Market volatility during the distribution phase can significantly affect portfolio longevity. We provide a different approach to distribution planning, ensuring your retirement funds are protected.

At Kesten Financial Group, we aim to educate our clients and offer services to reduce market risks, create tax reduction plans, and maximize retirement income.

We review past tax returns and analyze them holistically, determine retirement savings goals, provide guidance on annual retirement account withdrawals to mitigate taxes, and assess the benefits of converting retirement accounts to Roth IRAs.

We also assist in estate tax planning, analyzing current assets, projecting growth, and finding ways to reduce estate tax obligations while transferring wealth seamlessly.

Now is the time to mitigate market risks, implement tax reduction strategies, and learn about maximum retirement income opportunities.

You can schedule a call with us for a complimentary retirement score and a customized roadmap unique to your situation.

Sequence of Returns.

Another important consideration in retirement is sequence of returns risk, so what exactly is sequence of returns?

Sequence of returns is a common phrase used to describe the yearly variation in an investment portfolio’s rate of return. Volatility is the short-term fluctuation in price or worth of a specific investment or financial market. Volatility is nearly impossible to eliminate, but it always has, and always will be, the pulse of the market.

The big question is how do market fluctuations, which deviate from the average return, affect the final value of a portfolio? And more importantly, how can they impact your retirement savings?

Accumulation Phase.

During the accumulation phase, when individuals are younger and still working, the focus is on the average rate of return.

Most people have heard of average rate of return because when one is in the accumulation phase and not withdrawing money, the average rate of return is the focus as it provides the overall performance of a portfolio over a period of time. Market ups and downs are not as concerning because there is no reliance on these funds for survival. The focus is on time in the market.

Distribution Phase.

However, the story changes dramatically during the distribution phase, when individuals are in retirement or close to retiring. At this stage, the focus shifts to sequence of returns, as funds are being withdrawn to support retirement expenses.

Market volatility becomes more concerning, as withdrawing funds during a down year can have a significant impact on the portfolio's longevity.

The truth is, that when not planning for sequence of returns, a portfolio can be decimated.

One needs a different strategy for the distribution phase than one uses to accumulate wealth in the accumulation phase.

The term used often is time in the market (the accumulation phase, to timing the market (distribution phase).

The focus is now on timing the market, which no one has a crystal ball to determine future outcomes. To illustrate this risk, let's consider an example.

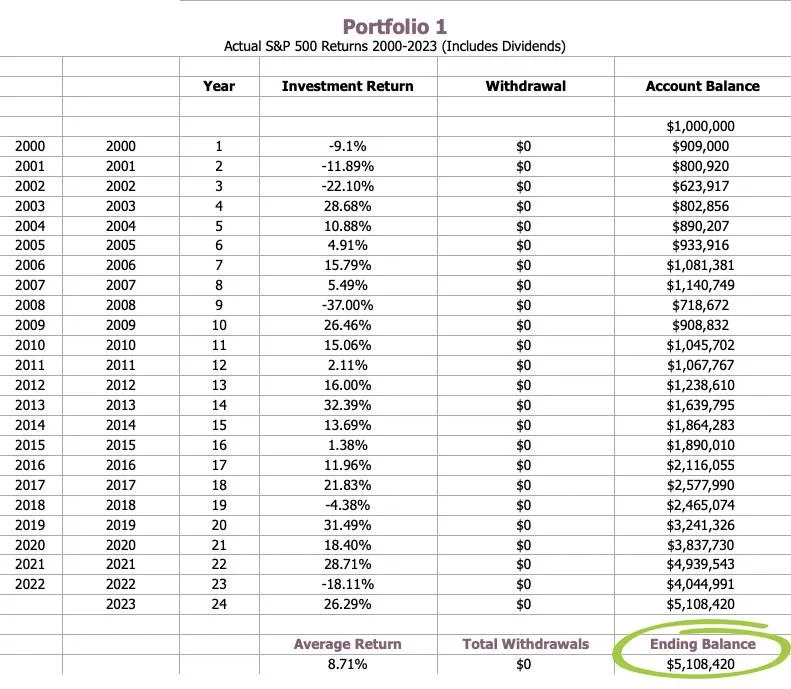

Two investors both start portfolios with lump sums of $1 million in 2000. Both portfolios earn an average rate of 8.71% over 23 years.

In portfolio 1, the annual returns represent the S & P 500 from 2000 to 2023. In portfolio 2, the annual rate of returns are in revers order, 2023 to 2000.

The ending balance, $5,108,429, is the same in both portfolios after 23 years regardless of the order of the sequence. Each portfolio averaged a 8.71% rate of return. This is the accumulation phase.

The total for each investor’s portfolio at the end of the 24 years accumulated the exact amount of money; an average rate of return of 8.73%; $5,108,420.

Please notice on the bottom both portfolios have the exact amount accumulated regardless of the sequence.

This is the accumulation phase.

This is the Accumulation Phase

Portfolio #1: 2000-2023

Portfolio #2: 2023-2000

In both scenarios each investor invested a lump sum and after 23 years has the same balance regardless of the sequence of the annual rates of returns. Each investor has after 23 years an average rate of return of 8.71% a year, even if the sequence is switched and in different order. At the end of 23 years each portfolio has a ending balance of $5,108,420.

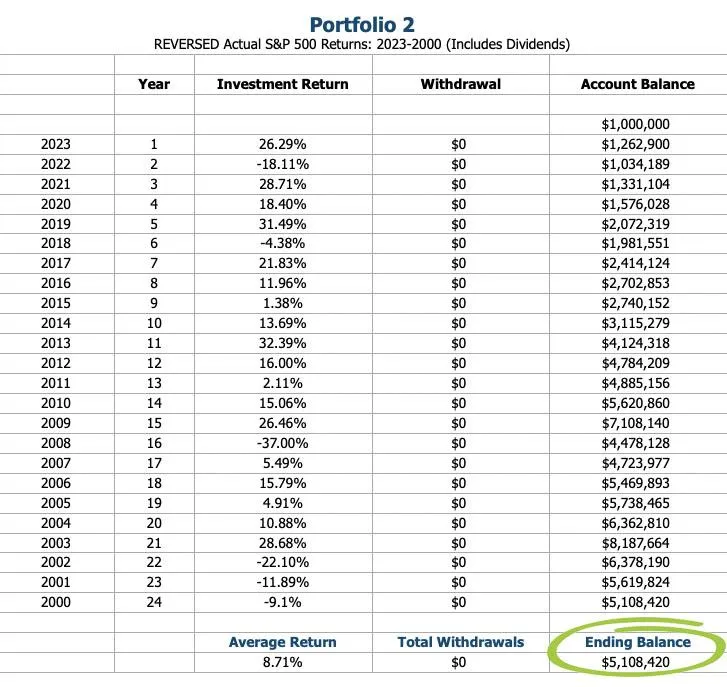

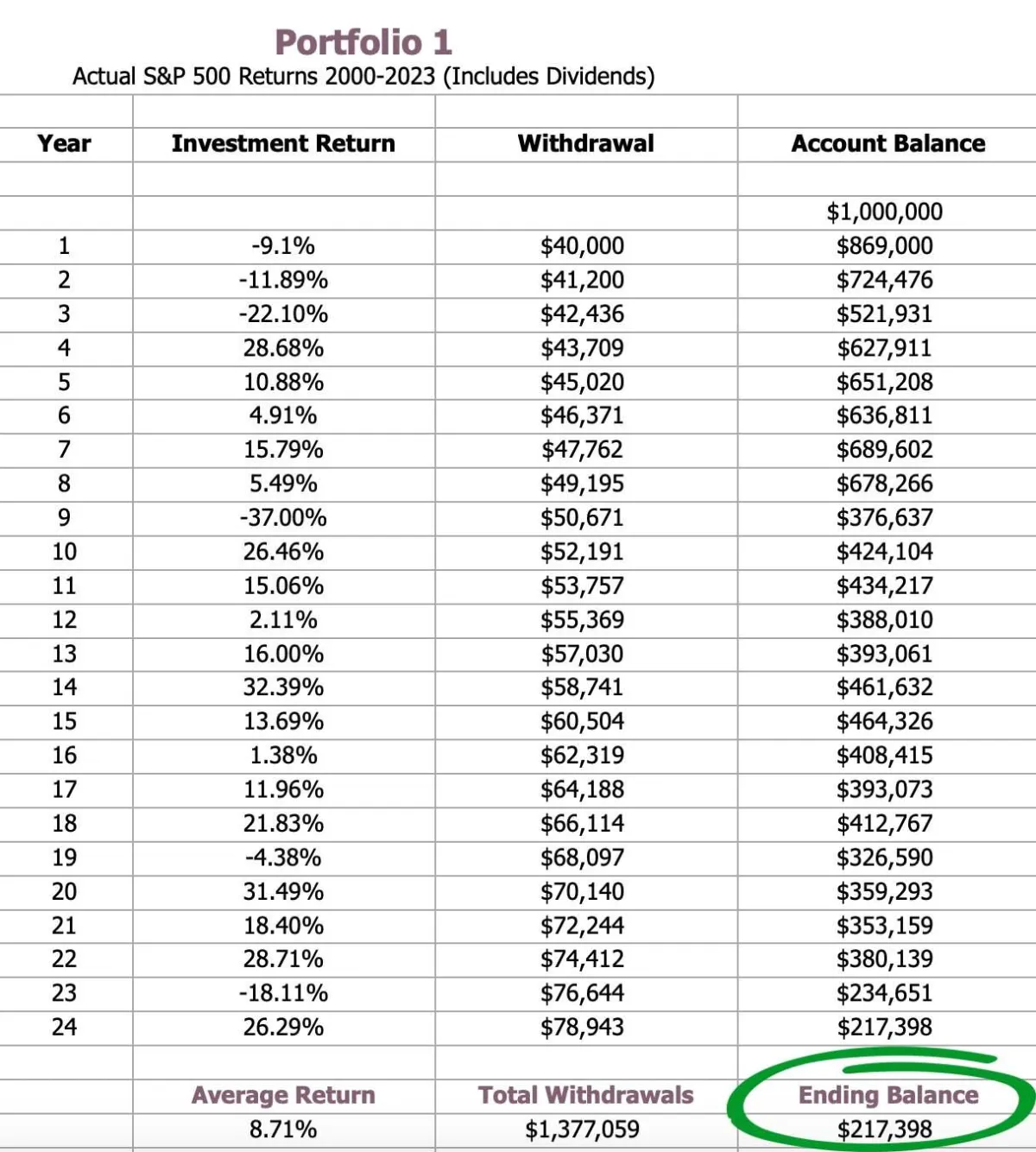

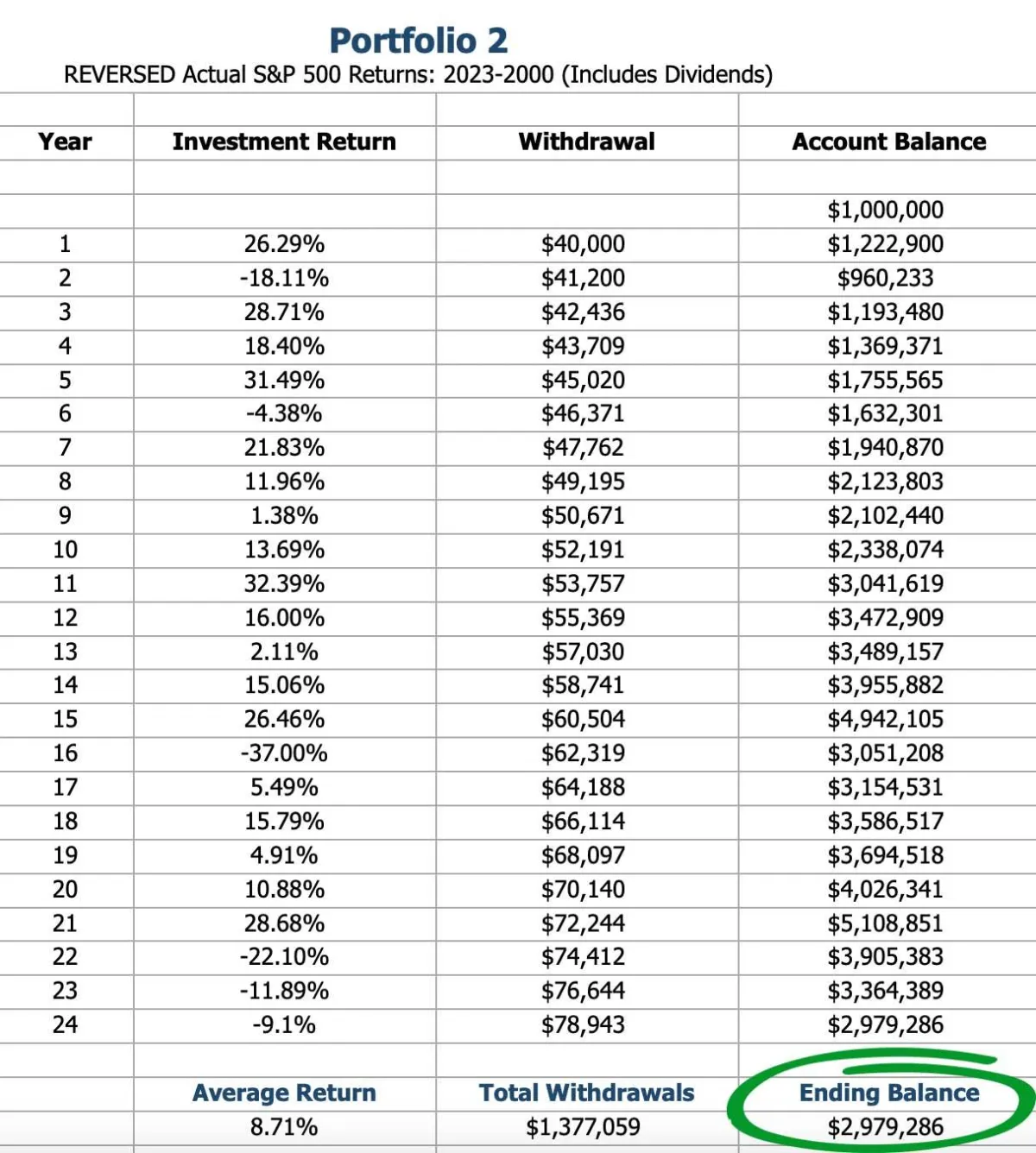

This is the Distribution Phase

Portfolio #1: 2000-2023

Portfolio #2: 2023-2000

Now, let's examine how the sequence of returns affects your portfolio during the distribution phase when the investor is accessing funds. We will consider the same two portfolios we discussed earlier, but with both portfolios withdrawing 4% from their portfolio.

Wow! After 24 years, there is a $2,761,888 difference between the two portfolios. One has $217,398 in their portfolio remaining after 24 years while the other portfolio has $2,979,286. This is a significant difference. The reason is sequence of returns has a profound affect when one is withdrawing funds, in this case 4%.

Let's discuss the market decline of 2008. During that year, the S&P 500 index, which serves as a comprehensive gauge of the stock market, experienced a 38% decline. To illustrate the impact, consider a retirement account that was initially funded with $500,000 in 1993. By 2008, the value of this account had grown to $1,589,852.

However, the following year, in 2009, the account experienced a significant drop and was reduced to $977,993. It took a duration of five years to fully recover from these losses. This is a notable length of time without any growth, particularly considering that no funds were withdrawn during this period.

It is clear that When one shifts from the asset accumulation phase to the asset distribution phase the strategy must also change.

If you are preparing to retire, having an understanding of the sequence of returns is essential and most advisors fail to advise their clients on this crucial part of the puzzle of the retirement planning process.

The Kesten Financial Group’s retirement roadmap Can Help You Understand & Protect Yourself From This Risk

To properly manage retirement assets and ensure current income requirements are met, a strategic withdrawal plan should be created that takes into account the timeline to reach your retirement date. Tax-efficient withdrawals will also help maintain sustainable withdrawal rates over time. This planned approach towards withdrawing from savings is essential in making sure you receive enough funds during your years of nonworking while protecting any remaining funds for use throughout the rest of one’s retired life.

Considering the potential challenges of sequence of returns, taxes and the withdrawal rate in retirement, it is crucial to have a well-thought-out distribution strategy in place. The Kesten Financial Group can provide guidance and solutions to help you navigate these challenges. With strategic retirement and distribution planning, it is possible to reduce or eliminate risk and position yourself to take advantage of future opportunities. The future doesn't have to be doom and gloom, and with the right planning, you can retire with confidence.

Strategies To Ensure Your Retirement Is Safeguarded.

1. Create a buffer bucket.

This allows one to switch withdrawing funds from one bucket to another while the market is down.

2. Safeguards.

Why risk crossing a broken down bridge to get to the other side if there is a sturdy brand new one right next to it?

Are you aware that there are products that can diversify your funds while offering guarantees that are equivalent to what one might be seeking in the stock market, and simultaneously protecting from stock market losses? Are you aware that there are products that provide a guarantee for life, both for you and your spouse.

Statistics have shown that retirees who receive a guaranteed income are happier than those that do not. It provides peace of mind and the freedom from worrying about the “wall of worry” so they can enjoy their retirement.

3. Determine your rate of withdrawal.

The question of when and how much to withdraw annually from retirement accounts to minimize taxes is a crucial consideration.

4. Tax analysis.

Determine if converting your retirement funds into a Roth IRA may be beneficial in saving in taxes and providing more funds for your retirement enjoyment.

5. Strategic Balancing.

While easy to focus on volatility as a single point in time, you may lose sight of the fact that over the long term, it has also created opportunities.

Balancing riskier investments with lower-risk options can help to create a more stable investment portfolio designed to take advantage of the potential buying opportunities created by market fluctuations.

At Kesten Financial group we are capable of:

Reviewing pass tax returns and have then holistically analyzed to determine how to save in taxes.

We also determine how much you must save to achieve your retirement goals or determine where are your shortfalls.

The question of when and how much to withdraw annually from retirement accounts to minimize taxes is a crucial consideration.

Determine if it is beneficial to convert qualified money (retirement accounts) into Roth IRAs, how much and over what period of time span. This potentially can mitigate taxes in retirement and provide a larger bucket of tax free dollars.

Determine if there is an estate tax problem, both federal and state, and how to protect your estate from the tax collector and seamlessly reduce your estate tax bill and transfer wealth. Planning for estate taxes involves looking at one’s current assets, while also projecting growth over the next years.

It’s never been more important than now to mitigate market risk, devise a tax reduction game plan, and learn strategies for the maximum retirement income. If you’re interested in paying less or possibly no tax, increasing retirement income, and never running out of money in retirement, make sure to schedule a call. It’s FREE.

At Kesten Financial Group, we strongly believe that an informed client is a valuable client.

As part of our services, we provide a retirement score, similar to a FICO score, which evaluates your current retirement outlook.

This score allows us to identify areas where simple adjustments can potentially improve your score. We then create a personalized roadmap specifically tailored to your unique situation.

The path of inaction

When individuals choose the path of inaction, they unknowingly expose themselves to significant risks that may only become apparent when it is too late. Ignoring or not properly addressing the concerns mentioned above can result in various consequences such as:

Diminished Purchasing Power: Neglecting to plan for inflation can lead to a decline in your purchasing power, gradually eroding the real value of your savings over time. It is important to account for inflation when developing your financial plan to ensure that your savings can effectively support your needs in the future.

Missed Opportunities: By adopting a passive approach, you run the risk of missing out on advantageous market shifts and potential investment opportunities. This lack of proactive engagement may prevent you from capitalizing on favorable conditions that could significantly enhance your financial returns. It is crucial to stay vigilant and stay informed of market trends and opportunities to make the most of your financial strategy.

Increased Vulnerability to Market Volatility: Without strategic planning, your portfolio becomes more vulnerable to market volatility and downturns. Failing to develop a well-thought-out investment strategy can leave you unprepared for unexpected market fluctuations, which could have a detrimental impact on your financial situation.

Unpreparedness for Retirement: Failure to address the Sequence of Returns Risk can put the stability and longevity of your retirement funds at risk. Ignoring this risk means you may experience negative returns early in retirement, depleting your savings faster and diminishing your overall financial security.

Additionally, neglecting tax planning can result in a larger portion of your assets going towards taxes, leaving you with less to enjoy during your retirement years. It is crucial to take both of these factors into account when preparing for retirement.

This path often leads to reactive decision-making, exacerbating financial vulnerabilities and hindering your potential for growth and security.

However, it's important to note that the future doesn't have to be gloomy. We believe that we are currently on the brink of unprecedented growth and opportunities.

In order to seize these possibilities, strategic retirement and distribution planning are vital.

With the right planning, it's not only possible to minimize or eliminate risks but also position ourselves to benefit from these upcoming opportunities.

Let’s plan to thrive and not just survive.

After years of hard work and dedication, you have reached a crucial point in your life and deserve to enjoy a life of abundance.

It's essential to make informed decisions and take proactive steps to secure a fulfilling and financially stable future in order to reap the rewards of your efforts.

As we navigate through these uncertain times, the choices made today have the power to shape your financial future.

By choosing Kesten Financial Group, you're not merely selecting a financial advisor. You're opting for a committed partner dedicated to guiding you towards financial prosperity.

Our company boasts a wide range of resources and teams, consisting of tax specialists, estate planning attorneys, financial and investment consultants.

Together, we can provide you with valuable insights into structuring your retirement plan to enhance tax efficiency.

We'll discuss practical strategies for managing your tax burden, leaving you with more financial resources to enjoy your well-deserved retirement.

At Kesten Financial, we are dedicated to navigating you through these complexities, ensuring that your financial future is not just secure but thriving.

Schedule a call to receive your retirement score.

Disclaimer: Felicia Kestenberg is an agent with New York Life Insurance Company(NY,NY), offering its annuity and life insurance products, as well as those from a subsidiary, New York Life Insurance and Annuity Corporation(a Delaware Corporation). Guarantees are based on the claims-paying ability of the issuer. Felicia Kestenberg is also a Financial Adviser for Eagle Strategies LLC, a Registered Investment Adviser and New York Life Company and is also a registered representative of NYLIFE Securities LLC(member FINRA, SIPC), a licensed insurance agency and New York Life company, 420 Lexington Ave, 15th Flr, New York, NY 10170, 646-227-8626. CA Insurance License #0L25974

Kesten Financial Group is not owned or operated by New York Life Insurance Company or any of its affiliated companies.

Neither New York Life Insurance Company, nor its affiliates or agents, provides tax, legal, or accounting advice. Please consult your own tax, legal, or accounting professional before making any decisions.